MEXICO AUTOMOTIVE SUPPLY CHAIN IN 2025

Insights for buyers & suppliers: top 10 sourcing clusters and emerging opportunities

Looking to understand why Mexico has become the new epicenter of automotive purchasing? You’re in the right place. In this article, we’ll explore how Mexico’s strategic location, skilled workforce, and growing network of suppliers have transformed it into a key hub for global automotive sourcing.

At Automotive Meetings Queretaro, we’ve spent years connecting international buyers with top-tier Mexican suppliers, witnessing firsthand the country’s rapid rise in the global automotive supply chain. Our experience organizing B2B meetings for OEMs, Tier 1s, and Tier 2s gives us a front-row view of how purchasing strategies are evolving in Mexico.

Having organized B2B meetings in Queretaro and other international hubs (Madrid, Bursa, Torino, Michigan) for years, we’ll next map the country’s clusters (Querétaro, Guanajuato, Nuevo León, Puebla, Aguascalientes, etc.), then unpack where buyers should source (components, EV & powertrain, logistics) and present three immediate sourcing opportunities your procurement team can action.

Fill out the form to receive the full report on the automotive supply chain, including the main hubs and the top sourcing clusters in 2025.

Mexico’s Key Automotive Hubs: Querétaro,

Guanajuato, Puebla & Nuevo León

Mexico’s automotive industry supply chain doesn’t revolve around a single city — it’s a network of specialized clusters, each with its own DNA. Together, they create a dynamic ecosystem that fuels the country’s rise as a global hub for automotive purchasing and supply chain excellence.

Querétaro: The Engineering, Logistics & Innovation Powerhouse

Read more

Querétaro: The Engineering, Logistics & Innovation Powerhouse

Nestled in the heart of Mexico, Querétaro has evolved into a magnet for engineering and R&D investment. The state is home to more than 350 automotive-related companies, including Tier 1 and Tier 2 suppliers specialized in precision components, metal stamping, and electronics. Querétaro’s universities and research centers collaborate directly with manufacturers, making it a center for innovation and process automation. Its strategic position — connected by major highways and close to the Bajío industrial corridor — also makes it a logistics hub that supports just-in-time delivery and efficient regional distribution.

Querétaro stands as a prime example of how Mexico’s automotive purchasing and supply chain strategy integrates innovation with infrastructure.

Guanajuato: The Manufacturing Core

Read more

Guanajuato: The Manufacturing Core

Guanajuato is the production engine of Mexico’s automotive industry supply chain. Hosting major OEMs like General Motors, Toyota, Mazda, and Honda, the state is a powerhouse of vehicle assembly and component manufacturing. Around these OEMs orbit a dense network of Tier 1 suppliers in areas like transmission systems, metal casting, and plastics. The Silao–Celaya corridor exemplifies nearshoring efficiency, attracting constant investment from international companies looking to shorten lead times and strengthen supplier proximity.Forme

Puebla: Tradition Meets Transformation

Read more

Puebla: Tradition Meets Transformation

In Puebla, the automotive story runs deep. As home to Volkswagen de México and Audi’s high-tech plant in San José Chiapa, the region combines decades of experience with modern innovation. Puebla’s suppliers excel in interior systems, stamping, and vehicle assembly, supporting one of Latin America’s most advanced automotive ecosystems. The local government’s support for green mobility and EV component development also signals a forward-looking shift in the automotive purchasing and supply chain landscape.

Nuevo León: The Northern Gateway for Global Supply Chains

Read more

Nuevo León: The Northern Gateway for Global Supply Chains

Strategically bordering the United States, Nuevo León has become the gateway of Mexico’s automotive industry supply chain. The state hosts over 200 international suppliers and key OEMs such as KIA and Ternium, supported by a robust logistics network through Monterrey. Its strengths lie in metalworking, advanced materials, and export logistics — ideal for nearshoring and direct integration with U.S. automotive operations. The region’s emphasis on sustainability and smart manufacturing adds an extra layer of competitiveness.

Top 10 Sourcing Clusters for Automotive Purchasing in Mexico

Central location, innovation ecosystem

Strong industrial base, workforce availability

Skilled labor, EV transition support

Border proximity, USMCA advantage

Efficient logistics, high automation

High-end production, skilled engineering

Heavy industry cluster, low logistics cost

Northern export hub, U.S. connectivity

Access to capital, infrastructure

Tech-driven manufacturing, innovation labs

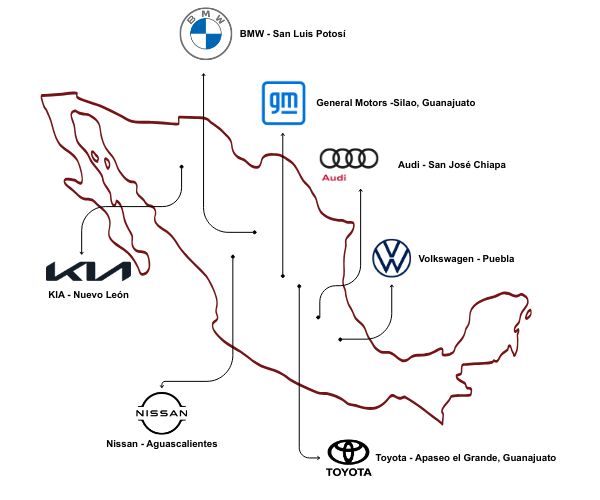

Regional Advantages: Logistics & Workforce Insights

Each cluster contributes to the strength of the automotive industry supply chain in a different way.

These regional dynamics allow international buyers to balance cost, efficiency, and innovation — the three pillars of modern automotive purchasing and supply chain strategy.

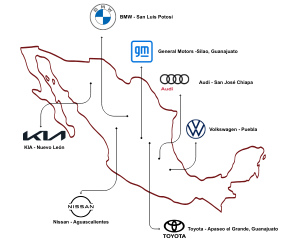

OEM and Tier Network Mapping: Connecting Mexico’s Automotive Ecosystem

Supplier–Assembler Connections: A Network in Motion

What makes Mexico’s automotive industry supply chain exceptional is its interconnectivity. OEMs collaborate closely with Tier 1 and Tier 2 automotive suppliers through local supply parks and shared logistics hubs. This integration reduces lead times, strengthens quality control, and enables rapid scaling — key benefits for global procurement teams seeking reliable sourcing in the Americas.

Querétaro and Guanajuato, for instance, illustrate this synergy: engineering firms in Querétaro provide design and testing services for assembly lines in Guanajuato, while Puebla’s specialized Tier 2 network feeds directly into Audi’s premium production.

Purchasing Trends 2025: Nearshoring, Digital Procurement, and Sustainability

The landscape of automotive purchasing and supply chain in Mexico is rapidly transforming. In 2025, global sourcing strategies are being rewritten — and Mexico stands at the center of this shift. Three major forces define the evolution: nearshoring, digital procurement, and sustainability.

Top Challenges Buyers and Suppliers Face in 2025

While Mexico’s automotive purchasing and supply chain ecosystem grows stronger, several automotive supply chain issues remain critical.

- Logistics Integration Gaps

- Component Dependency

- Cost Instability

OEM and Tier Network Mapping: Connecting Mexico’s Automotive Ecosystem

To overcome these automotive supply chain issues, Mexican companies are adopting smart solutions

that blend technology and collaboration.

1

Innovation Through AI and Automation

Artificial intelligence is driving predictive logistics and supplier quality control. Firms like Tremec (Querétaro) and Metalsa (Nuevo León) are using automation to improve production consistency and delivery accuracy.

2

Traceability

and Transparency

Blockchain-based traceability platforms are being tested by Tier 1 suppliers to ensure part authenticity and compliance — a growing trend in the automotive supply chain optimization movement.

3

B2B

Collaboration Platforms

Events like Automotive Meetings Querétaro play a vital role in connecting OEMs, Tier 1, and Tier 2 automotive suppliers list members through curated B2B matchmaking, accelerating collaboration and shortening procurement cycles.

Mexico is not just participating in the international automotive industry supply — it’s shaping it. With thriving clusters, advanced logistics, and world-class B2B events like Automotive Meetings Queretaro, the country is building a future where buyers and suppliers connect smarter, faster, and more sustainably.

Whether you’re a global OEM, a Tier 2 automotive supplier, or a logistics innovator, Automotive Meetings Queretaro 2026 is your gateway to the heart of the automotive purchasing and supply chain revolution — where business meets innovation, and Mexico drives the world forward.